“Not everything that counts can be counted, and not everything that can be counted counts.” Albert Einstein

☝️This rings true now more than ever for L&D.

With more pressure than ever to ‘prove the business value’ of learning initiatives, now’s the time L&D need to get super savvy with data.

Not just with learning data. But with business data.

But what do we actually mean by that in practice? And how exactly can L&D move away from optimising learning initiatives around vanity metrics that have no real demonstrable impact on the business?

How would you feel if you went to your doctor and she started speaking you in Mandarin? (Or any other language you don't speak).

How on earth could she diagnose your problem if she doesn't even speak your language?

It's exactly the same when talk about speaking the language of the business. As L&D leader, Joti Joseph, said on a recent session we ran about this topic on LinkedIn, "...I have seen senior business leaders sleep with their eyes open when we present competency frameworks in our gobbledegook speak."

I don't know about you, but I don't want to be the person who puts people to sleep 😴 when I present my team's initiatives to them!

If you want to build stronger partnerships 🤝 with the business and position L&D as a core function of the business (not a support one), then you need to get serious about developing your business acumen.

This includes everything from your company's market segments to its competitors and the macro economic challenges in the wider industry.

You'll see the conversation changes entirely. Business leaders will start to value your opinion. And more importantly, they will seek it.

So if you're fed up 🤦♀️ of being brought to the conversation after the problem has (presumably) been diagnosed and being asked to develop a course when you know it’s not the solution, read on.

There are lots of ways you can go about building your business acumen that don't involve getting a masters degree! Here’s a list of really practical ways suggested by Kevin Cope in an article on the Training Industry’s website.

Let's be honest here. You're not going to pick your company's financial statements as your bedtime reading. But, they’re invaluable in strengthening your understanding of the business.

Make sure you pay attention to key metrics 📈 in your company’s income statement, balance sheet and cash flow statement. And if you don’t understand some of the metrics, that’s fine. Just look them up. Resources like Investopedia are brilliant for this.

Go and find someone in your company’s finance, strategy, sales, digital or marketing departments and ask them to mentor you. This is what Jo Maitland, Global Digital Learning Director at L'Oréal, did. Her mentor changed the landscape of data and reporting in the learning team.

Ask your mentor questions about their role and the challenges they face. This will give you ideas on how you can support them too. Make sure you meet regularly and ask them to help you understand the parts of the financial statements or earning calls you’re struggling with.

You might not understand everything that’s said but that’s OK. Take notes and discuss the key points with your mentor. The more of these calls you join, the more you’ll understand. It won’t happen overnight but persistence pays off.

There are tons of sources for business news including Harvard Business Review, Forbes, The Economist, the Wall Street Journal and Bloomberg.

If you’re like me and prefer the summary roundup with your morning coffee ☕, check out The Morning Brew Newsletter.

When you’re reading or watching the news, try and think about how it might affect or relate to your company and industry. Take notes and discuss them with your team or mentor.

Reading is a great way to improve your business acumen. You don’t need to read books from cover to cover. Dip in and out as needed. Here’s a list of 10 books to get you started.

Grab a coffee with colleagues from other areas of the business and ask them lots of questions about the challenges they’re facing in their roles and departments.

Get to know your customers. Tune in to what they’re saying about your company on social media and in NPS survey feedback.

This will give you invaluable insights into where some of the problem areas are in the business.

It will take time and persistence to build strong business acumen. And if this is something you've never done, it will probably be uncomfortable too. But that's what learning is all about right? 😉

We are all guilty of this one and we all need to stop. There are some metrics than in isolation, mean nothing.

Let's take a contentious one - engagement with your learning platform.

I’m not saying engagement isn't important.

What I’m saying is in isolation, it doesn't tell you anything about the real impact your learning initiatives are having on individual or business performance.

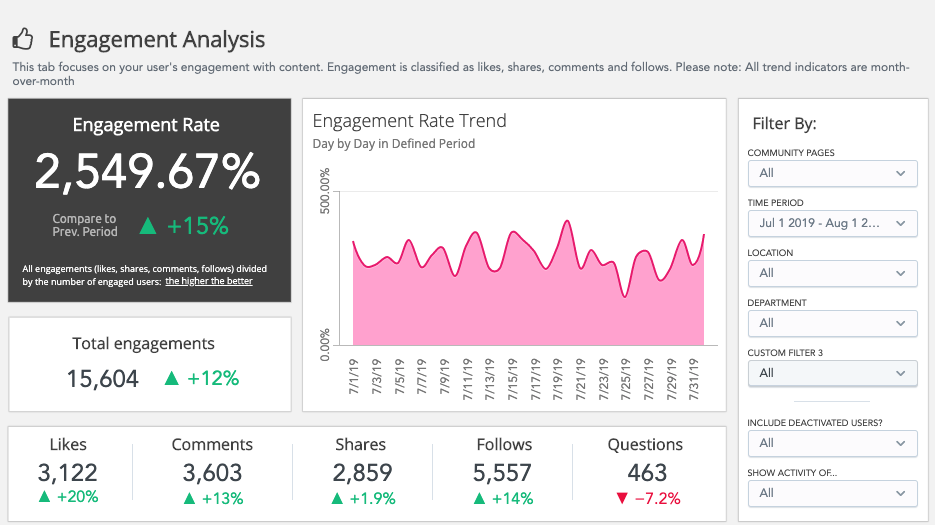

Engagement is one of the many metrics we look at via our Analytics tool in Fuse. We calculate it by looking at the number of engagements a user has had in our platform by the total number of users we have.

I can very easily manipulate engagement by posting videos of cute cats on Fuse and I’d get heaps of engagement. But it doesn’t mean my audience have actually learned anything new. Well, apart from the fact that cute cat memes always cheer them up.

Engagement is not a good proxy for learning. But it is a prerequisite. If your learners aren't even visiting your learning platform, then it's hard to get them to consume any learning content.

For engagement to become a meaningful metric, we need to use it as a leading indicator.

Leading Indicators are the metrics that will change before we see the impact on the business.

Lagging indicators are the metrics we look at to determine whether there’s been an impact on the business. They’re what we hypothesise the leading indicators will affect. These might include attrition, customer churn, NPS or ATV (average transaction value).

You have foresight with leading indicators and hindsight with lagging indicators. This is why starting off with a clear hypothesis is so important. (Here's 👇 a guide to help you create measurable hypotheses).

Let me share an example to bring this to life. One of our customers is Panasonic. They use Fuse to support their care agents. They had a problem - staff turnover was very high and customer and employee NPS was low.

Bruce and Cheryl who lead their customer service team spent time with the care teams across markets to understand the underlying issues.

They found that care agents felt isolated, were not receiving up to date product information and they didn’t have a safe place to ask questions, or share good practice with each other.

Their hypothesis was that if agents felt engaged, happy and informed, customer NPS and agent retention would increase.

The leading indicators they were looking at included engagement, active usage and returning users. They also looked at how often agents were asking questions and sharing good practice.

The lagging indicators were employee and customer NPS as well as staff retention.

If you’d like to learn more about how Bruce and Cheryl went about exploring the business problem, check out this video 👇.

We’ve all been in those meetings where a business leader will point out a problem her team is facing and demand training.

Years ago I worked for Nokia. I was the retail analyst for their North African cluster.

When sales would drop in a territory, the immediate reaction of our regional sales managers was to give the reps more training. It took time to get them to realise there were a number of factors impacting the sales.

Not all of these could (or should) be addressed with training.

I found the most effective way to build a case was to go out and explore 🕵️ what was happening. Here’s how I’d approach this exploration:

Doing all this enabled me to build a holistic picture of what was happening.

And more often than not, it was not a straightforward solution to train the sales reps. The problem was a combination of things.

To address it meant working with our retail marketing team on point of sale material, supporting the sales reps with objection handling techniques, working with the sales team on promotional offers and running competitions to incentivise the reps.

There’s no way I would get this level of understanding if I had just sat at my desk and read a few reports.

You have to roll up your sleeves and make it your mission to understand the underlying challenges.

Talking data with the business isn’t the end goal. The ultimate aim for L&D is to add value to the business and become a driving force behind its success.

To become this force, you need to be data-savvy and be able to identify the underlying business needs. That way you become proactive in solutioning rather than reactive (and conceding with creating yet another course).

I know it can be overwhelming. But remember, understanding the data and unpacking the business needs is an art and a science. There are principles but there is no one right way of doing it.

The best advice I can give you is just start. Find a mentor, go buy some business books, read those reports, schedule a coffee with someone in another department.

Taking the first step is often the hardest but trust me, once you get started, there's no looking back.

I’m on a mission to support L&D to learn more about data and measurement. So leave me a comment 👇 and tell me, what would you like to learn more about?

These Stories on Learning Measurement

© 2022 Fuse Universal - All Rights Reserved

Comments (2)